Recommendation: Begin by identifying a reputable local partner who can hold the required local stake while you steer governance and design. This limited-ownership strategy accelerates licensing during the formation phase and reduces friction with authorities.

In Qatar, licensing often hinges on a local presence such as a national service agent or joint venture. Build a clear governance framework early, and prepare a thorough dossier of documentation. Expected timelines: initial approvals 2–4 weeks, full licensing 4–8 weeks depending on sector-specific scrutiny; prepare to provide sector studies and compliance checks during the process.

encompass key steps: licensing, tax registration, and market-entry permissions in a single plan. studies on demand, supplier reliability, and local procurement should feed a design of controls and a rolling auditing calendar. If a branding concept like a rosa line or a parfumerie products portfolio is explored, align labeling with local regulations and consumer expectations. Treat milestones around product launches and customer birthdays as practical progress markers to enhance brand experience.

Begin with a staged entry: a mini pilot in a controlled segment, then incremental expansion. Maintain a tranquil, sobre risk posture to avoid over-commitment while you test waters in the market. This approach helps optimize capex and keep working capital aligned with inflows. Consider a simple, scalable structure that can accommodate additional partner involvement as the business grows.

Auditing and compliance: implement a practical timetable and appoint an external auditor for year-end checks. Use studies from regulatory bodies to shape internal controls, and ensure your partner is accountable for day-to-day compliance. This reduces surprises and creates a resilient framework for scaling across multiple sectors in the Qatari ecosystem.

Implementation plan: within 90 days secure a local representative, finalize the formation documents with transparent ownership records, open a corporate bank account, and register for tax and import permissions. Create a lightweight design and product-dossiers to support early offers and market feedback. This disciplined approach accelerates time-to-revenue and stabilizes operations as you expand into new sectors.

Gulf State Business Setup Essentials

Start with a tailored plan and hire a licensed local advisor to accelerate registration within 4–6 weeks, faster than traditional routes. The plan aims to facilitate market access and ensure accurate compliance across approving authorities. Begin with an ownership and sector audit to avoid wasted trips and duplicate work; the aim is a seamless setup that keeps operations running smoothly.

Choose a suitable business entity in the gulf state, such as a limited liability structure, with 100% ownership possible in several sectors. Confirm capital needs, and document readiness, including bylaws and a local service agreement. A compact, mini unit can scale to capacity gradually, letting you test markets without large exposure; this effective approach reduces risk while building credibility.

Utilize regional hubs such as dubai to streamline logistics, supplier audits, and banking relationships. A robust due diligence (studies) ensures the capacity to scale, with accurate KYC checks and reviews of licensing requirements. Corporates can open accounts with local banks after a bank readiness review; this seamless process reduces surprises and delays.

In fragrance and consumer goods, an olfactory testing suite and quality control are essential; plan a mini line to test markets and gather reviews early. In fragrance lines, use an atomizer design to minimize leakage and optimize packaging. Use seasonal campaigns around birthdays and holidays; offer small gift bundles to drive sales. Track customer feedback frequently to refine formulation and packaging; keep product capacity aligned with demand.

Keep documentation accurate and up-to-date; adopt a compliance calendar with frequently updated checklists, annual licenses, and tax registrations. Build a small team in-house or work with a local partner who can handle regulatory filings, licensing, and reviews of corporate governance. This effective plan reduces overhead and accelerates go-to-market, even when market conditions shift and throw in some surprises.

Conduct studies of market demand, competitor pricing, and consumer behavior. Use data to tailor product messages, e.g., fragrance lines with distinct olfactory signatures; emphasize quality and consistency. A sobre approach to branding helps in regulated environments while preserving authenticity. Ensure campaigns are messaging-aligned and measurable, with frequent reviews of ROIs and channel performance.

With proper planning, the path becomes seamless and effective, enabling scale from a single mini unit to a regional network. Maintain capacity planning and quality control; the key is alignment between product development, supplier reliability, and market acceptance. This approach yields fewer surprises and supports steady running of operations, even when you launch on milestones like birthdays or seasonal campaigns, building long-term brand trust.

Choosing the Optimal Legal Structure: LLC, Joint Venture, and Free Zones

Recommendation: Choose a Free Zone setup in Qatar to meet rapid market entry, available 100% ownership, and a streamlined system with easy processing. This exclusive path suits startup teams seeking speed and control; public licenses can be issued within 3–6 weeks in many cases. Reviews from large ventures emphasize the irresistible advantages, including translation support and open access to regional markets. Notes: lattfa checks appear in licensing workflows, frequently guiding staff through the complex sequence toward operations, and their presence helps align investment plans with compliance needs.

LLC route typically requires a local partner with a majority stake (their share) and governance that encompasses board representation and capital controls. Establishing such an entity does not reach 100% ownership in most activities, though investment licenses can create exceptions via government approvals. This path remains a solid option when public procurement access and local market integration matter; it also yields easier banking and visa processes for key personnel.

Joint Venture arrangements suit large investment, strategic collaboration, and risk sharing. They enable leveraging local networks and provide aligned governance, shared profits, and access to public tenders. Processing times frequently run 4–8 weeks depending on approvals; contracts typically require meticulous notes to cover ownership, exit, and dispute resolution. This route encompasses the benefits of collaboration, a scalable platform to start operations, and the ability to expand into new segments with a shared ecosystem.

Notes: decision makers often begin with the Free Zone option, then establish the LLC or JV as growth requires; startup teams can adapt quickly, leveraging the fama from market players. The open Free Zone system supports available services, translation capabilities, and an irresistible speed level, making this the most common starting point in Qatar’s market. Investment planning should include lattfa considerations and a review of processing timelines to select the path that best matches their growth notes.

Document Checklist and Visa Requirements: Founders from Outside

Align with the regulatory officer early to define a verified set of originals and translations covering all required documents. Starting with passport data pages, birth certificates, and educational credentials, secure translations by a certified translator. This opening package includes corporate governance papers (board resolutions, original incorporation letters or equivalents), lease agreements, and proof of address; translations should be Arabic or English. The process, which viene with stamping guidelines, ensures clear identification and meets officer expectations. rosa stamps may accompany originals; maintain a clean set of copies for reference, and include the compra history of key suppliers to support due diligence. This setup supports the corporation’s personality and helps meet growth aims; founders grow with experienced teams.

To prepare, gather items requested across submissions: identity papers, professional credentials, financial evidence, and governance documents. All items not in English or Arabic must be translated and verified, keeping both original and translated copies. When applicable, obtain apostille and embassy legalization on originals or certified copies. Build links with local banks to support opening of accounts and to back the starting phase of operations. In high-end ventures, a well-documented package increases the chance of an officer-approved outcome. The set ensures smooth review and a growth trajectory.

| Category | Required Items | Translation/Attestation | Notes | Typical Timeline |

|---|---|---|---|---|

| Applicant Identity & Background | Passport copy (bio page), two passport photos, birth certificate, police clearance (country of origin) | Original copies; translations into English/Arabic by certified translator; notarization as needed | Ensure passport validity ≥6 months; officer may request birth and marriage documents where applicable | 2–4 weeks |

| Education & Professional Credentials | Diplomas, transcripts, professional licenses | Translations English/Arabic; apostille; embassy attestation | Verifiable and issued within last 5 years; provide verification letters if possible | 2–4 weeks |

| Corporate Governance & Entity Papers | Board resolutions, articles of incorporation, commercial registration, lease agreement | Originals + translations; MOFA attestation; embassy legalization | rosa stamps may be required on originals; ensure corporate personality | 2–5 weeks |

| Financial Evidence | Recent bank reference letter, latest 3–6 months bank statements, proof of paid-in capital | Bank letters on official letterhead; translations; verify signatures | Link to banking relations; compra history included | 3–5 weeks |

| Visa & Immigration | Employment offer letter, sponsorship letter, visa application forms, two passport photos | Translations; any required medical form; police clearance (visa-specific) | Medical exam at approved center; officer interview may be required | 2–6 weeks |

| Permits & Special Equipment | Industry permits, import permits for equipment (atomizer devices), insurance | Translations; legalization where required | Obtain permits before import; some activities demand additional compliance | Varies |

After submission, stay in touch with the assigned officer; once verified, the file supports opening bank accounts and faster onboarding of local staff, helping the entity grow with an irresistible competitive stance.

Registration Timeline: From Preliminary Approvals to Issuing a Trade License

Begin with name clearance and translation-ready documents to minimize back-and-forth with authorities. This approach speeds up the regulatory process in this Gulf jurisdiction.

-

Preliminary approvals and name clearance

- Typical duration: 3–7 business days; up to 10–14 during peak periods.

- Deliverables: proposed legal form, activity scope, bilingual descriptors; test brand names such as rosa and lattafa for conflicts.

- Notes: keep a small purse of alternative names to accelerate selection if the first choice is rejected.

-

Drafting constitutional documents and translation

- Documents: Articles of Association, by-laws, power of attorney; ensure translation into Arabic and English with certified professionals.

- Timeline: 5–10 days for drafting; 2–5 days for translation and notarization; avoid vacio fields (empty) in submissions.

-

Choosing entity type and aligning with regulatory expectations

- Entity types available: LLC, branch, representative office; select based on jurisdictionwhether you prefer single-entity setup or multi-branch expansion; establishing multiple branches increases permits workload.

- Impact: ownership structure, capital requirements, and governance differ by choice; select early to avoid later revisions and ensure passion for the business model.

-

Office presence and address validation

- Evidence: provide a physical address or compliant virtual office; typical lease terms cover at least 12 months.

- Prerequisite: address validation supports registration and reduces post-approval changes; plan accordingly for transports of goods and markets.

-

Sector permits and regulatory clearances

- Permits: obtain sector-specific approvals (cosmetics, public services, or consumer goods); ensure product class such as accessory or fragrance has the relevant permits.

- Timeline: 2–6 weeks depending on sector complexity and material readiness; parallel processing with sector authorities accelerates outcomes.

-

Submission, review, and public disclosures

- Submission: assemble the dossier with translations and attestations; verify consistency across documents.

- Public register: some filings appear publicly; confirm the listing reflects the intended scope including branches and activity types.

-

Issuance of the trade license and post-approval steps

- Outcome: final clearance yields the license, enabling commercial activity and bank dealings.

- Next steps: register with the chamber of commerce, complete tax and payroll registrations, implement governance and reporting routines, and ensure ongoing translation readiness for regulatory communications.

Operational tips:

– Compare timelines with dubai to identify efficiency gaps; entities offers accelerated processing on straightforward cases; among the options, external partners can offer translation and regulatory services to speed obtaining permits.

– Build a compact dossier of licenses and permits; establish much momentum by aligning with market needs such as rosa branding and lattafa branding, and prepare for transferring goods including transports and physical outlets with public visibility.

– Maintain passion for compliance; position yourself as a credible operator with clear branding, product classification like fragrance and accessory lines, and robust translation workflows.

– Ensure branding checks include bilingual naming; rosa and lattafa should clear trademark requirements in parallel with regulator checks.

– Always avoid leaving fields vacio in forms; fill every field completely to prevent processing delays.

Shareholding Rules and Capital Requirements: Non-Qatari Participants

Recommendation: llcs with a Qatari partner must hold a majority stake (51%) in mainland setups; non-Qatari participation is capped at 49%, ensuring regulatory compliance and a smoother obtaining of licenses.

In zone environments, open options exist to achieve 100% ownership in selected activities; such opportunities are available in designated zone authorities (zone) and require alignment with zone policies and licensing criteria set by bodies such as QFZA, which offers several such deals.

Capital prerequisites vary by license type; banks review liquidity, risk profile, and capacity to support initial operations; prepare a credible plan with accurate projections to secure approvals and minimize delays; do not proceed without clear indicators.

Name clearance is mandatory; the chosen name must be unique and comply with branding policies; preparing multiple options accelerates approval and the process of obtaining licenses and opening bank accounts.

Intellectual property protection encompasses trademarks and branding; perfume lines and other fragrance assets require timely registrations; brand names such as Yara may be pursued; IP filings should be integrated into the business plan to encompass compliance and growth.

Partnership arrangements with a Qatari counterpart should specify governance, capital calls, and ongoing compliance; such frameworks support a successful venture and protect stakeholders; ensure accurate records, including appointment birthdays, and implement strong security controls.

Procurement processes (compra) must align with local policies; available open tenders exist; maintain transparency; monitor the fruit of supplier relationships and ensure security of supply chains; avoid vacio fields and fill them before submission.

Costs, Licenses, Taxes, and Post-Incorporation Compliance

Starting with a verified local advisor, map all upfront and ongoing costs, including license fees, registration charges, office requirements, and annual renewals.

Licensing options vary by activity. Most common tracks cover commercial, professional, industrial, and service activities. Seeking an exclusive, high-end setup within a business zone can simplify establishing operations by delivering an integrated package that envelops licensing, bank onboarding, immigration support, and facility needs.

Tax considerations include no personal income tax; corporate profits taxation applies to certain entities with rates that depend on activity, and withholding taxes on cross-border payments can apply depending on the instrument. VAT is not implemented in the current regime. In multinational operations, seeking a Spain-based partner can assist with cross-border planning and compliance alignment.

Post-incorporation compliance includes maintaining statutory books, filing annual financial statements, and undergoing audits where required; license renewals occur on an annual cycle; keep ownership records updated, and sustain a compliant payroll and visa process for expatriate staff. A robust package from a single provider facilitates carrying out these duties across areas in a centralized manner.

Operationally, starting with a zone-centric plan yields the most predictable path. The most attractive options envelop reduced fees, clearer rules, and ready-to-use facilities, which appeals to lovers of efficiency and exclusive services. Always align zone selection with a scalable strategy centric to long-term success, including ongoing services from Spain-based partners as needed.

Company Formation in Qatar – A Comprehensive Guide for Foreign Investors">

Company Formation in Qatar – A Comprehensive Guide for Foreign Investors">

Ambergris in Perfumery – History, Scent, and Modern Alternatives">

Ambergris in Perfumery – History, Scent, and Modern Alternatives">

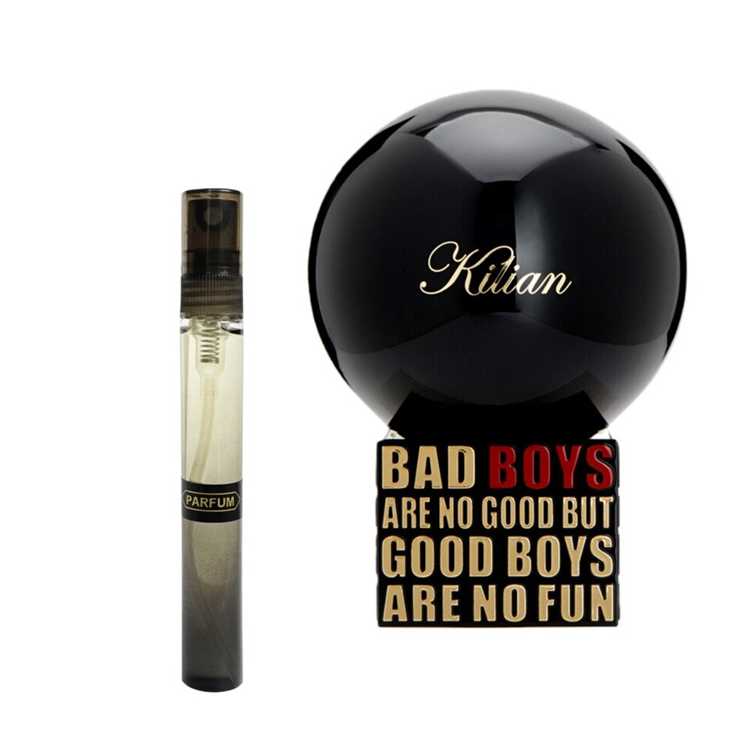

Born to Be Unforgettable – Bad Boys Aren’t Good, But Good Boys Aren’t Fun (Kilian 2018)">

Born to Be Unforgettable – Bad Boys Aren’t Good, But Good Boys Aren’t Fun (Kilian 2018)">

Les Eaux Primordiales Ambre Supermassive Review – Amber Fragrance Analysis">

Les Eaux Primordiales Ambre Supermassive Review – Amber Fragrance Analysis">

Ambergris Oil by Houbigant – Reviews, Perfume Facts and Scent Notes">

Ambergris Oil by Houbigant – Reviews, Perfume Facts and Scent Notes">

Reminiscence Ambre Réminiscence Eau de Toilette – Fragrance Notes & Review">

Reminiscence Ambre Réminiscence Eau de Toilette – Fragrance Notes & Review">

Andraus Parfums Fragrances – Reviews and Information">

Andraus Parfums Fragrances – Reviews and Information">

Kilian Angels’ Share Paradis Review – Is It Better Than the Original?">

Kilian Angels’ Share Paradis Review – Is It Better Than the Original?">